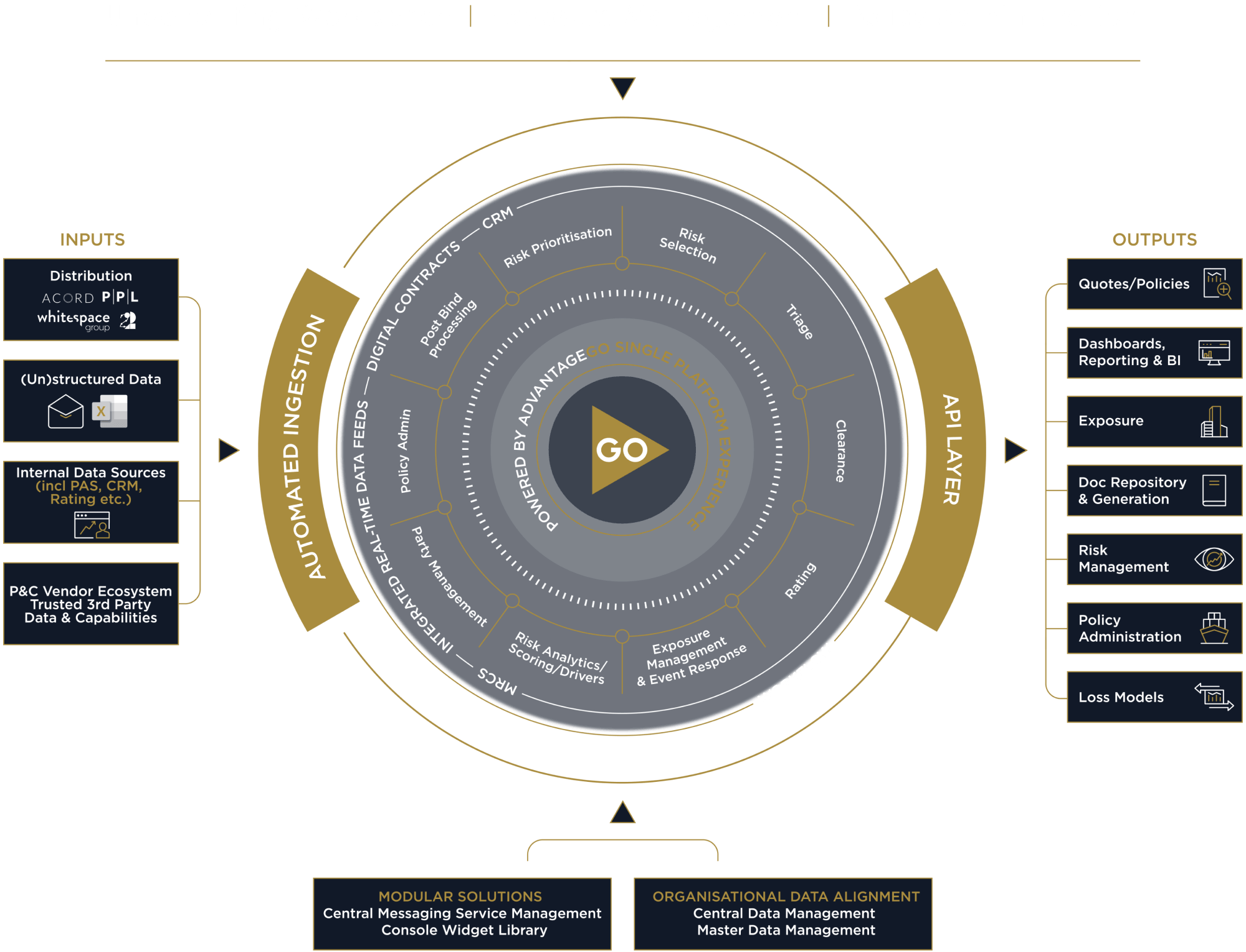

Exposure Management

Act fast with real-time exposure insights

Quickly | Intelligently | Accurately

Access the latest insights into portfolio drivers with AdvantageGo’s exposure management software, so you can stay up-to-date on portfolio exposure and align optimal risk selection with risk appetite.

A single platform for (re)insurance exposure management

Make fast, accurate underwriting decisions

Replicate contract T&Cs across any financial dimension. Increase the speed and accuracy of underwriting decisions, align to underwriting capacity and support decision-making with geographical visualisations and representative hazard information.

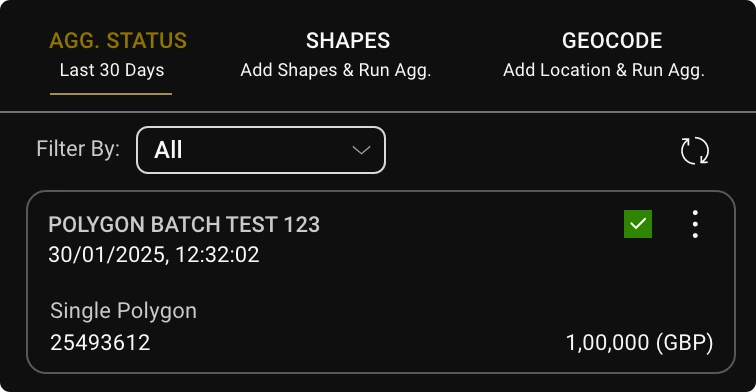

Manage your global direct or reinsurance asset portfolio

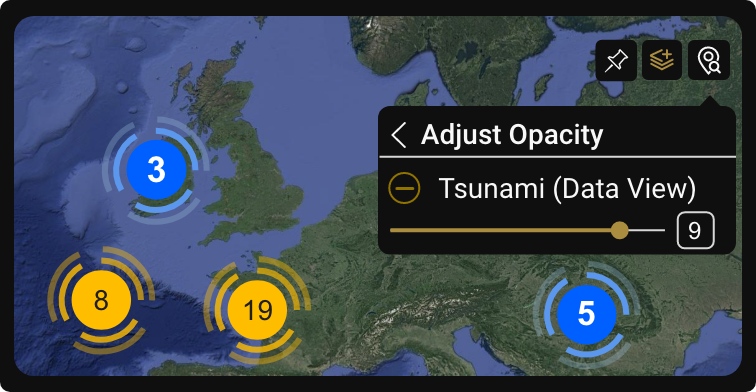

Drive portfolio assessment through risk-level marginal impact and steer your portfolio in line with the organisational risk exposure appetite. Manage complex risks in real-time, over multiple P&C lines and across financial net/gross positions with detail and accuracy. Undertake scenario modelling and footprints to validate your portfolio’s resilience to specific perils and to monitor exposure hotspots.

Respond to hazard events as they happen

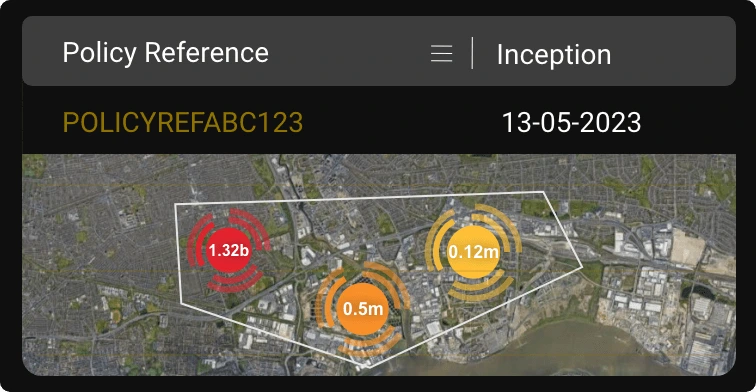

View event footprints and identify risks affected by single or correlated hazard events with real-time exposure calculations, differential PMLs for a prescriptive and predictive analysis of exposure concentration.

See treaty reinsurance at scale

Accurately visualise your global treaty portfolio of billions of locations in real-time, at any financial dimension and over thousands of cedents. Overlay footprints and run exposure scenarios.

(Re)insurers rely on our exposure management software at scale

750,000+

policies processed per year.

>60 million

calculations to date.

1 billion

insured assets.

Features

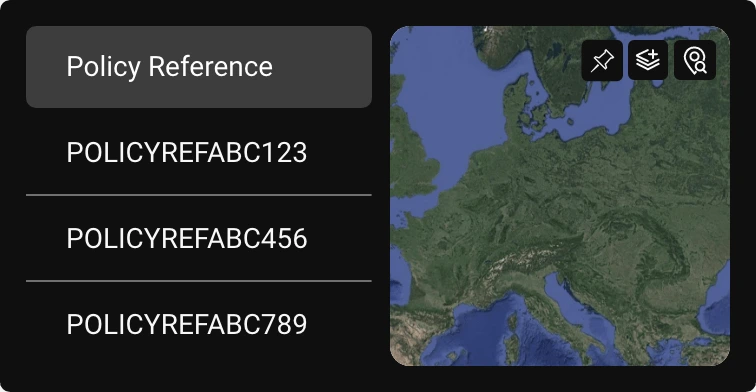

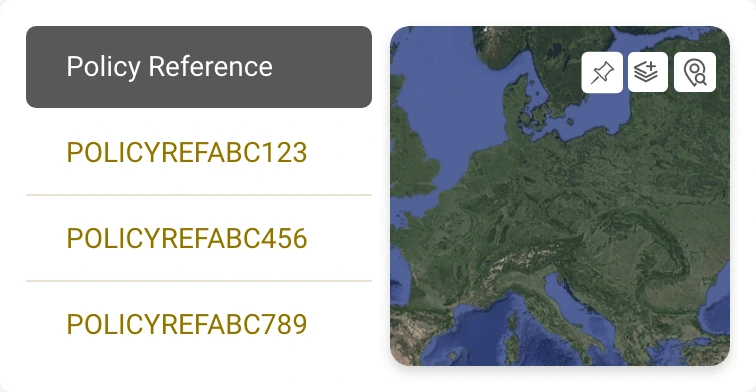

Underwriter view

Support smarter underwriting decisions and risk selection by reviewing risks pre-bind. Combine policy and location summaries, peril scores and hazard layers with your own scenario-driven exposure analysis, and visualise potential clash – all measured against your portfolio risk appetite thresholds to give a comprehensive view of your exposure.

Net exposure evaluation

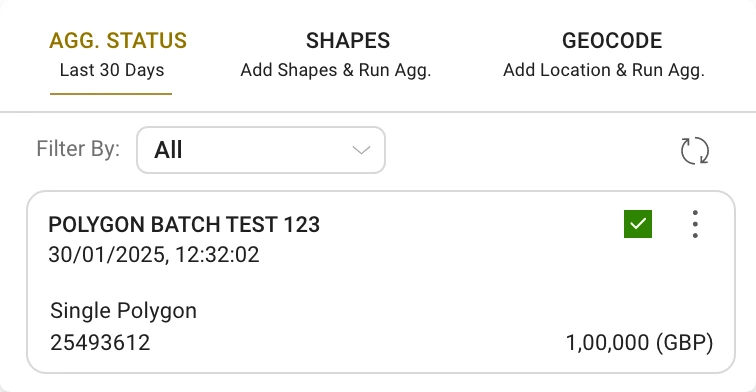

Assess the impact of new quotes on any aggregation scenarios by performing marginal impact analysis with our market-leading risk aggregation engine, and see how your existing portfolio is affected.

360° view of risk

Identify and visualise peak accumulations in your portfolio with our proximity exposure algorithm. Check on your insured locations in real time using our integrated GIS view.

3rd party data integration

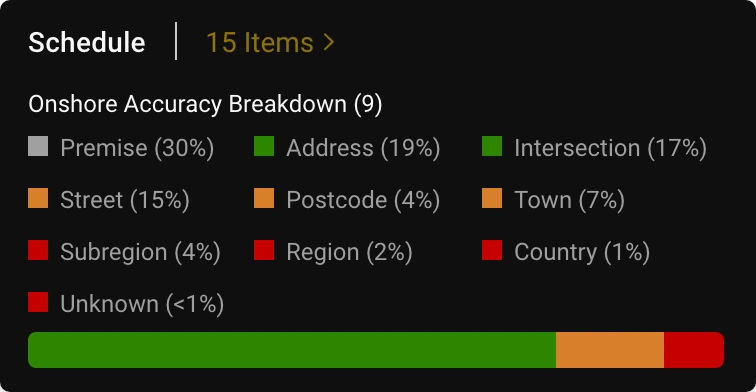

Integrate with multiple sources of peril, location and company information to consolidate and interrogate data points in our single platform. Optimise underwriting decisions using hazard overlays and risk scores.

Customisable persona-driven analytics

Communicate accumulation information seamlessly across the business with our customisable risk dashboards and flexible ad-hoc reporting. Calculate potential exposure for real-time events and track developments as they happen with shape file exposure analysis.

Detailed portfolio assessment

Identify hotspots and assess each cedent’s portfolio in granular detail with map visualisations, year-on-year comparisons and peer-to-peer benchmarking.

Experts you can rely on

Future-proof your transformation investment with our proven technology and the commercial insurance expertise we’ve developed working with leading carriers across multiple lines of business for more than 30 years. AdvantageGo is built on customer success and backed by continuous investment from our parent company, Sapiens.

>1/4 use AdvantageGo

More than a quarter of Lloyd’s syndicates trust AdvantageGo software.

30+ Years

We have over 30 years of commercial insurance experience.

£500+ Billion

We support insurers underwriting a combined GWP of over £500 billion.

A new standard in Exposure Management

The Hartford went live with Exact and currently use the system across their global property and marine lines, including Political Violence & Terrorism, Inland Marine and Onshore & Offshore Energy.

Easy configuration for your multi-line P&C (specialty) business

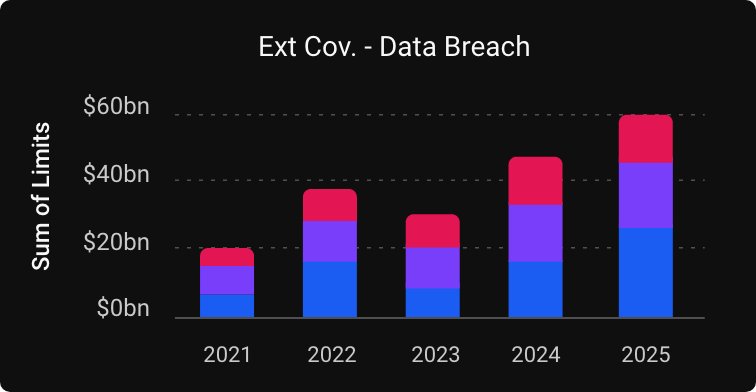

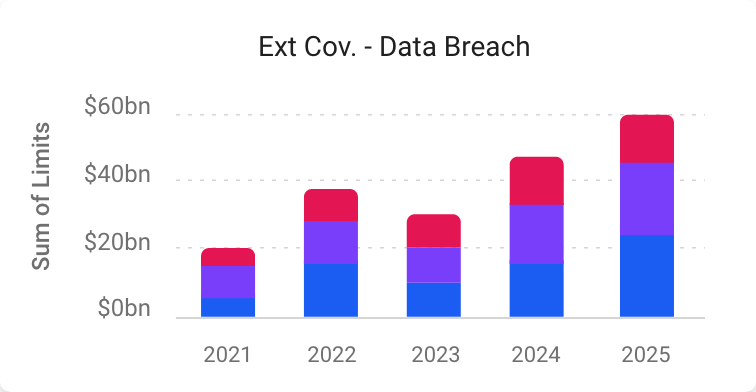

Cyber

Be ready to move fast with the cyber templates and data connections in our underwriting workbench capability.

Property

AdvantageGo enables you to improve risk selection and portfolio strategy for property underwriting and exposure management.

Energy

All systems go with the energy templates and data connections in our underwriting workbench and exposure management capabilities.

Marine

Make ready for an integrated flow of information to support marine cargo, vessel, fleet, liability, and insights for builders and owners.

Terrorism

Differential PML concentric circles, polygons that represent typical Realistic Disaster Scenario explosive patterns.

Aviation

Our underwriting workbench delivers an integrated flow of information to support cargo, hull, fleet, liability and ground aviation insight.

General Liability

Our underwriting workbench creates an integrated flow of information supporting property damage and body/personal injury underwriting insight.

Political Risk

Our workbench creates a flow of information to support regulations, war, civil unrest, terrorism, embargoes, sanctions and climate insight.

Trade Credit

Our workbench creates an integrated flow of information supporting customer financial health, credit history, industry and market conditions.

Capture and report aggregate accumulations across multi-line P&C.

View all financial positions that align to the T&C’s of the contract and represent the incurring structures, for an accurate perspective of asset and risk to portfolio level.

Our ‘out of the box’ renewables data model records onshore and offshore wind farms, solar farms, wave/tidal plants, substations or any other structure or property related to a renewables policy.

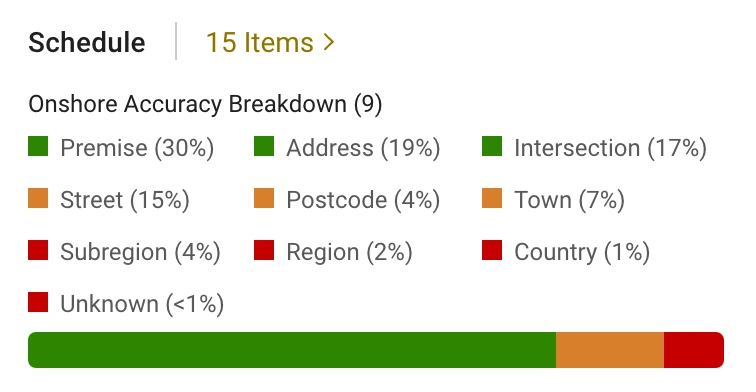

Populate your schedule data quickly with manual or automated lookups against our industry database. Check exposure on any recorded characteristics, inspect linked assets and assess risk for contingent business interruption losses.

Connected specialisms is what I preach. So here at AXA, we have our AdGo user interface trading product workbench, but it’s connected to WTW’s Radar Live for pricing sophistication and other providers for the likes of geocoding. What you have is an underwriting ecosystem of really top-end solutions.

-

David Ovenden

CUO

-

Press release

Underwriting

-

Kier James

CUO

Our exposure partners

Leading technology providers in the AdvantageGo Ecosystem currently include:

Latest insights

‘A global initiative underway’ – Tokio Marine’s Chris Williams highlights ambitions in the opportunity-rich renewable energy market

Chris Williams is a dynamic leader deeply passionate about collaborating with renewable energy companies. In the lead-up to his interview with Voice of Insurance...

Part 4 of Cyber Roundtable: Is Cyber a Systemic Risk?

The cyber threat landscape has changed dramatically over the last decade, but one question remains: Could a single cyber event trigger a chain reaction...

The MGA model is broken – Antares CEO

Antares’ CEO Mike Van der Straaten is the latest executive to feature on the Voice of Insurance podcast, produced in association with AdvantageGo...