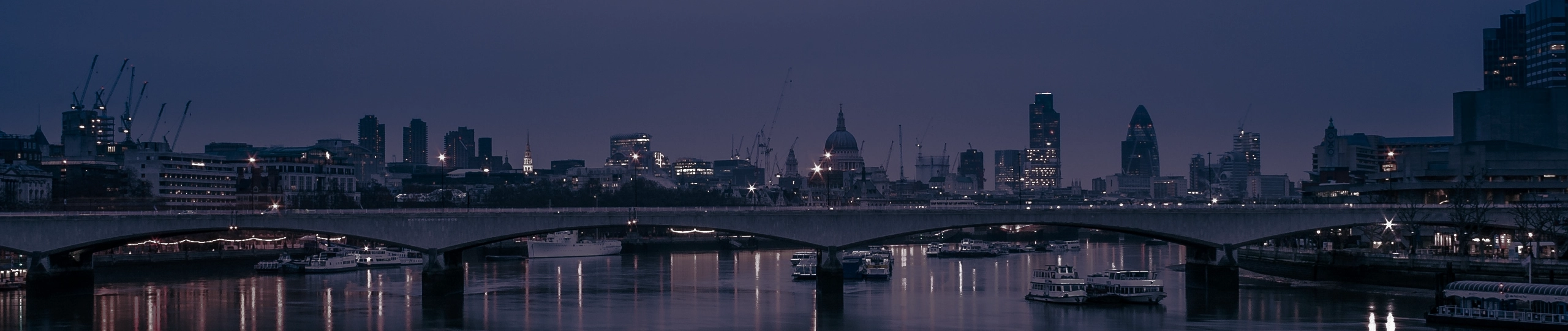

AdvantageGo | ECOSYSTEM

The AdvantageGo | Ecosystem offers insurers the choice of leading technology providers through a single source to accelerate digitisation.

The AdvantageGo | EcosystemYOUR DESTINATION FOR ACCELERATING DIGITISATION

The AdvantageGo | Ecosystem of strategic alliances with leading technology, data and analytics providers in each space leverages our respective solutions jointly. The AdvantageGo | Ecosystem delivers a comprehensive technology proposition through a single source to accelerate and digitise operations.

The AdvantageGo | Ecosystem enables insurers to adopt the latest technology more quickly, achieve cost efficiencies, and deliver an exceptional customer experience.

The synergies offered by the ecosystem provide advanced and unique solutions at different points across the commercial insurance and reinsurance value chain, empowering clients to meet the industry’s aspirations to move to a digital-first insurance economy.

A global hub of insurtech innovation, where clients can seamlessly access technology, knowledge and advice, the AdvantageGo | Ecosystem is the go-to destination for insurers seeking cutting-edge technology to create an effective digital transformation strategy to:

Increase operational efficiency

Increase incremental revenues

Introduce new revenue streams, products and services

Promote risk reduction and mitigation

Enhance decision-making in real time

The AdvantageGo | Ecosystem supports carriers globally to undertake a more coherent adoption path to digitising processes and for those operating in the London Market to efficiently take advantage of Blueprint Two services coming down the line.

The AdvantageGo | Ecosystem manifests itself in AdvantageGo working with best-of-breed suppliers who complement our offering, providing clients with a more comprehensive single view of a risk transaction by pulling data from the technology suppliers and augmenting that with the client’s data to enable better underwriting decisions.

AdvantageGo manages the customer’s support, their security and brings that to the market as an end-to-end solution through a single contract

“It’s removing the mundane admin, freeing up the experts to do the job they do best.”

Eva Taylor,

Senior Associate

“The logical platform of combining all those partners into a wider Ecosystem. You could build a very bespoke best solution for every insurer, like a tailored suit, made of off the shelf parts. It can be the AWS for Insurance tech and I think that’s a very interesting and exciting spot to be in.”

Patrick Ebert,

Enterprise Architect

“I’ve run a lot of tenders in this market for clients and what you see is what you get here, it’s not smoke and mirrors.”

Eva Taylor,

Senior Associate

ALLIANCES

Leading technology providers in the AdvantageGo | Ecosystem currently include:

AdvantageGo leverages ADEPT for Global Reinsurance and Large Commercial (GRLC) to facilitate connection, for example, with the AdvantageGo Underwriting workbench, to the digital services and solutions introduced as part of the Lloyd’s Blueprint Two initiative.

ADEPT’s RESTful API service allows AdvantageGo clients to send and receive ACORD GRLC accounting (EBOT) and claims (ECOT) messages via these next-generation solutions. ADEPT will also enable AdvantageGo clients to transact with other ACORD GRLC-enabled partners around the world, including between stakeholders in the Ruschlikon community.

AdvantageGo’s Underwriting Workbench platform integrates with Combined Ratio’s IMPACT product suite to provide access to fresh insights for (re)insurance carriers with limited CRM data on their assureds and/or brokers. The integration of IMPACT Engage and Underwriting Workbench allows clients to drive underwriting efficiencies, while keeping value on the agent and broker relationship.

This alliance provides client opportunities that will enable the AdvantageGo Underwriting Workbench to give greater insight and analytical capability, for example to provide additional opportunities to cross-sell to assureds, maximize underwriter’s efforts with high value activities and foster deeper relationships with intermediaries.

DOCOsoft’s integrated claims management system (CMS) empowers users to work smarter and get more done. The constantly evolving DOCOsoft CMS keeps (re)insurance carriers ahead of the game, flexing to deliver what they need, when they need it.

Connecting with DOCOsoft through the expanding AdvantageGo Ecosystem creates a virtuous circle between two platforms meaning, for example, while AdvantageGo’s policy administration system can provide core policy data to DOCOsoft, DOCOsoft’s enriched claim record can be fed into AdvantageGo Underwriting, giving underwriters a holistic view of business written.

Expleo provides an essential toolkit in providing testing strategies and then running those tests to provide assurance that technology works the way it’s supposed to work, ensuring that systems can connect and communicate seamlessly across the market, and that there are no unexpected consequences for digital transformation.

This implementation partnership provides an independent testing assurance on all aspects of Blueprint Two, leveraging a deep understanding of AdvantageGo’s Subscribe solution. This will help to smooth the transition for AdvantageGo’s clients as they look to meet the challenges of the programme.

FortifyData is an integrated cyber risk management platform that enables the enterprise to manage threat exposure across the organisation. By combining automated attack surface assessments with asset classification, risk-based vulnerability management, security ratings and third-party risk management, you get an all-in-one cyber risk management platform.

This partnership layers ecosystem data providers offered through the cyber-specific edition of AdvantageGo’s Underwriting Workbench, specifically meeting the needs of cyber underwriters. Clients benefit from cyber security ratings which are a best-of-breed insight for risk selection, pricing, as well as security and compliance control deficiencies.

Insurants is a leading document processing solution, designed to revolutionise the commercial insurance industry by automating and streamlining key processes throughout the policy lifecycle. Built on advanced AI, GenAI and machine learning technologies, Insurants delivers operational efficiency and accuracy, enabling insurance companies to better serve clients, govern risk exposure, optimise capital and remove manual processes.

By integrating Insurants capabilities into the AdvantageGo Underwriting Workbench, organisations can optimise workflows, boost efficiency, and deliver superior client outcomes.

mea intelligently deploys technology, including AI, to quickly solve problems for (re)insurers, brokers and MGAs. mea’s software automatically extracts risk data from submission documents without any need for AI training or implementation effort, offering an instant solution and immediate value.

mea automates critical activities, boosting productivity, protecting combined ratios and margins. This alliance provides clients with the ability to access new data and insights and fresh capabilities faster.

Ping’s AI-powered, data-driven insights tailored for the property (re)insurance industry, leverage its proprietary global exposure technology. Unstructured property submissions, such as SOVs and ACORD forms, are rapidly ingested in just minutes, allowing seamless integration into customer systems.

Exposure intelligence is enhanced by enriching property data across various lines, including Property, Terrorism, Realty, and Builders’ Risk. API-enabled capabilities are designed to streamline insurance workflows and integrate smoothly with existing underwriting and broking ecosystems. With Ping and AdvantageGo insurers can enjoy greater efficiency, freeing up time and resources to work on something more meaningful.

Relativity6 addresses incorrect or out-of-date industry classification rating data and flagging of hazardous industries which allows underwriters to make key rating decisions on up-to-date classifications, using 6-digit NAICS, and other widely utilised class codes.

The cyber line-of-business will present scoring of business classification through AdvantageGo’s Underwriting Workbench, underwriters can use Relativity6 to instantly determine if a submission is within risk appetite, triage risks effectively, and price policies more accurately.

The Sea Change alliance provides change management specialists to drive desired business outcomes from the AdvantageGo ecosystem product set. With extensive insurance market knowledge, Sea Change delivers value from the full implementation lifecycle, including stakeholder training, lean process management and client support. The partnership works together to ensure transitions are smooth and everything is fully optimised within the business.

This brand of client-first consulting combined with deep insurance market knowledge can ensure readiness for Lloyd’s Blueprint Two, maintain Operational Resilience and align strategic business goals.

The alliance delivers solutions across the commercial insurance and reinsurance value chain that enable insurers to make more holistic decisions for their business across all lines. For example:

AdvantageGo’s Underwriting workbench, combined with Verisk’s pricing and rating service, Rulebook Rating as a Service, will provide a frictionless experience when assessing and pricing a risk, meaning that underwriters can turn business around faster, and with better risk clarity. Sequel Hub and Verisk Data Analytics are also part of the ecosystem play.

Verisk’s marketplace platform, Whitespace, can feed the structured data that is created and captured during the placement process, into AdvantageGo’s Underwriting workbench, meaning that underwriters can make faster decisions, and have clearer views of individual and portfolio risks, readily available at their fingertips.

AdvantageGo’s Underwriting workbench APIs will provide a frictionless experience when importing bordereaux data for delegated authority business by integrating with VIPR’s leading bordereaux management solution. This will ensure that raw Premium, Risk and Claims data being imported into AdvantageGo’s Underwriting workbench is standardised, cleansed, and validated against the contract terms.

This alliance will offer Underwriters the powerful benefits of AdvantageGo’s Underwriting workbench and a comprehensive and integrated view of their portfolio for both their open market risks and delegated authority.

AdvantageGo’s Underwriting workbench will be available with a pre-built integration of Zywave’s rating and distribution product, ClarionDoor, enabling users to develop, design and price risks in a customisable low-code/no-code environment. Providing a seamless, out-of-the-box experience, Underwriters and business users can centralise pricing across their entire portfolio and lines of business.

The integrated solution provides pricing capabilities whether the platform is quoting for new business, renewals or carrying out mid-term adjustments on existing business. A full pricing history is also maintained to enable cost validation and audit compliance.

OUR DATA PROVIDERS

The AdvantageGo | Ecosystem of strategic alliances is supported by data providers, experts in their field, who have been chosen because they share the same values and standards that we apply to our own business.

EXPLORE CREATING POSSIBILITIES TOGETHER TO DIGITALLY

TRANSFORM THE INSURANCE SECTOR

Thank you for requesting a demo. We’ll be in touch shortly to arrange a time and date.